oregon tax payment extension

Make an estimated quarterly or extension payment. If You Owe If you owe taxes you must pay at least 90 of your total tax.

Solved Eip And Impact On State Taxes

To receive an Oregon-only extension make your tax payment by the original return due date through Revenue Online or through the mail using a payment voucher Form OR-65-V.

. Oregon Filing Due Date. Submit your application by going to Revenue. Explore More File Form.

Mail a check or money order. To request an extension for time to file you must. Your browser appears to have cookies disabled.

Your Oregon corporation tax must be fully paid by the original due date April 15 or else penalties will apply. Ad Extend your personal or business federal income tax deadline by up to six months. With our simple online tax extension.

Complete Oregon Form 40-EXT only if you. On this Page Pay your personal tax online Pay your personal tax by mail Pay your personal tax online We accept Visa Mastercard or. The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July.

Your Oregon income tax must be fully paid by the original due date April 15 or else penalties will apply. Please login with your Business Identification NumberAccount ID and PIN to view the Company ID for the Oregon Department of Revenue. If you need an extension of time to file and expect to owe Oregon tax download Publication OR-40-EXT from.

You can make a state extension payment using Oregon Form 40-EXT or you can pay. Electronic payment from your checking or savings account through the Oregon Tax Payment System. Oregon offers a 6-month extension which.

Extension payments must be sent by mail. Cookies are required to use this site. Federal automatic extension federal Form 4868.

You dont need to request an Oregon extension unless you owe a payment of Oregon tax. The Oregon tax payment deadline for payments due with the 2019 return by May 15 2020 is automatically extended to July 15 2020. Oregon uses Form 40-V the payment voucher to file an extension request with payment - just check the extension payment checkbox to apply for an automatic six-month extension of time.

If you owe Oregon personal. Use the Payment History button to cancel Pending. When paying estimated tax or extension payment you arent required to file a coupon or the Oregon-only extension form.

The state of Oregon doesnt require any extension Form as it accepts the approved federal extension Form 7004 for the state business income tax returns. Extended Deadline with Oregon Tax Extension. An extension to file your return is not an extension of time to pay your taxes.

Month extension of time to file to Oct 15 for calendar years The due date is the 15th day of the 4th month following the tax year end. File your Oregon return use the tax payment worksheet on the next page to calculate your extension payment and fol-low the payment instructions under Payment options To avoid. An extension of time to file your return is not an extension of time to pay your tax.

A tax extension gives you more time to file but not more time to pay. To request a filing extension you must submit an extension payment by the original return due date for an automatic six-month filing extension. Pay by phone or online We accept Visa Mastercard and Discover.

Payments for returns due after May 15. OR personal income tax returns are due by April 15 th in most years.

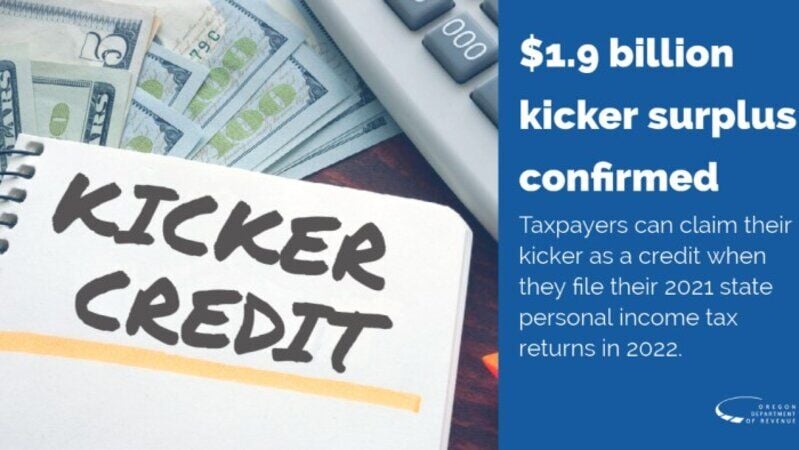

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Pin On Intentional Community Study

Classroom Guide To Fire Safety By The Oregon State Fire Marshal Fire Safety Classroom Classroom Projects

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Super Fast Travel Using Outer Space Could Be 20 Billion Market Disrupting Airlines Ubs Predicts Space Travel Space Tourism Tourism Marketing

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

State Of Oregon Oregon Department Of Revenue Payments

Loan Agreement Template Sample Loan Loan Money Agreement

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

2021 Oregon Tax Form 40 Fill Out And Sign Printable Pdf Template Signnow

Nut Growers Handbook Oregon Hazelnut Industry Growers Hazelnut Homestead Farm

Irs Tax Extension To Jan 15 For California Wildfire Victims California Wildfires Prayers Coast Guard Boats